Discover myAL myShare 2025

The myAL myShare 2025 offer is an opportunity to participate in the Group’s development by becoming a Shareholder or expanding your share portfolio on preferential terms.

Why invest in Air Liquide?

A resilient Group

Air Liquide’s strength is driven by the resilience of its business model, the diversity of its business lines, its various geographic locations and its ability to innovate for almost every sector of the economy. The Group draws on these robust foundations to continue to drive its long-term growth momentum and contribute to a more sustainable world.

A strong long-term performance

The ADVANCE strategic plan, which was launched in March 2022, consolidates these advantages and places Air Liquide on track to achieve a global performance by combining financial performance with non-financial performance.

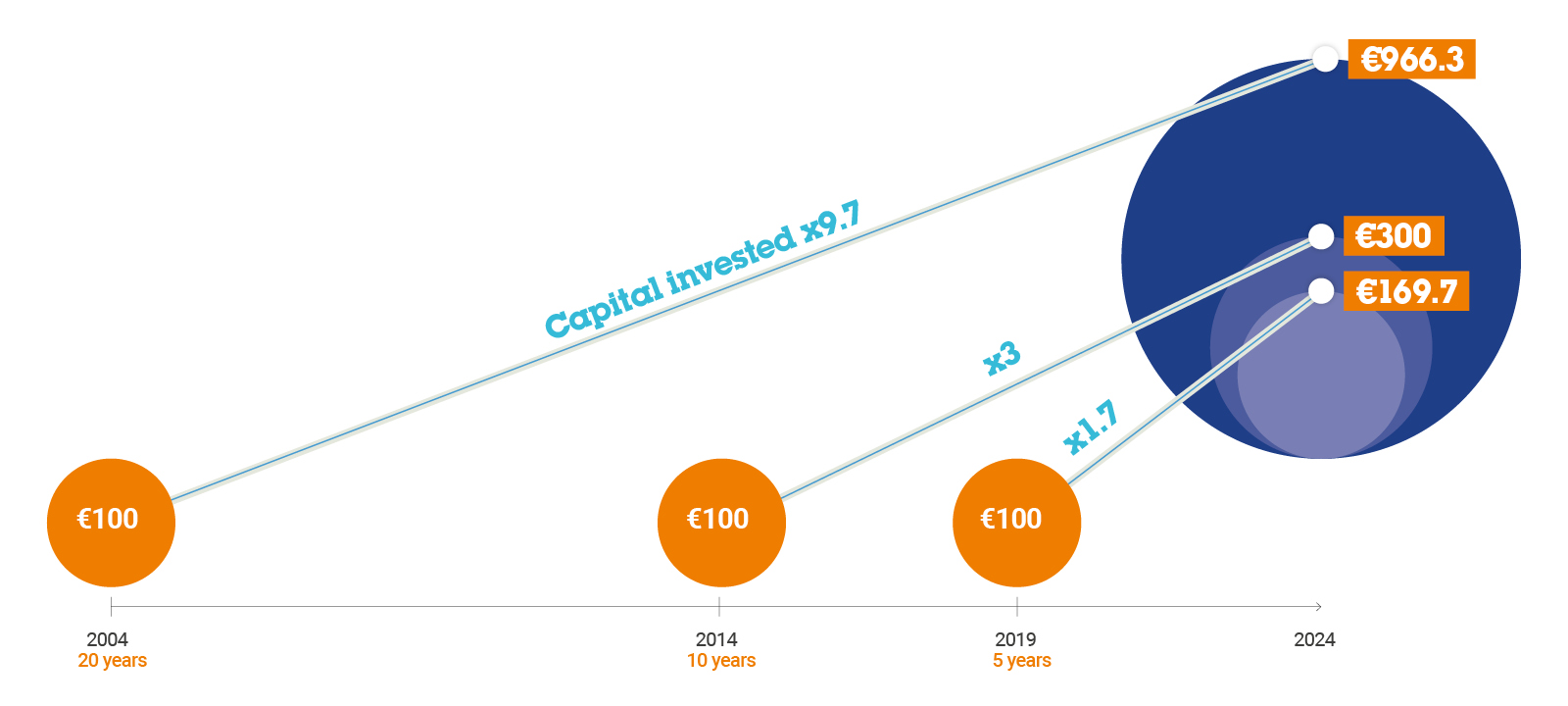

Over the past 20 years, the share price has risen steadily, as have the dividends paid out to Shareholders. By regularly reinvesting your dividends in Air Liquide shares, you can build a portfolio capable, for example, of financing a personal project.

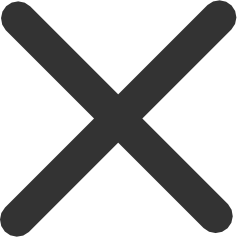

TOTAL SHAREHOLDER RETURN (TSR) OVER 5, 10 AND 20 YEARS(1)

(1) The Total Shareholder Return (TSR) is an indicator that calculates the performance of registered shares over a given period, including the change in the share price, dividends reinvested in shares, and bonus share allocations (both increased by the loyalty bonus). It also includes the impact linked to the use of preferential subscription rights during the capital increase carried out in 2016 as part of the acquisition of Airgas.

AIR LIQUIDE’S PERFORMANCE COMPARED WITH THE CAC 40(2)

(2) Air Liquide’s share outperforms the CAC 40, which is the benchmark index comprising France’s 40 largest companies by market cap. Share price at December 31, 2024. Adjusted according to current Euronext rules. Any investment in equities carries a risk of capital loss. The past performance of Air Liquide shares is no guarantee of future performance. This does not constitute financial investment advice. You can consult the risk factors mentioned in the Universal Registration Document, available at airliquide.com.

Why subscribe to the myAL myShare 2025 offer?

20% discount

The reference price is equal to the average opening trading prices of the Air Liquide share over 20 consecutive days. A 20% discount is applied to this reference price. The discounted price is the subscription price.

Payment options

You man pay for your subscription in full upfront or through interest-free payroll deduction over 26 pay periods, depending on local offer conditions.

Become a direct registered shareholder.

What are the benefits?

1 share = 1 voting right You are part of your Group’s decision making process by voting at the annual General Meeting.

+10% loyalty bonus on dividend You will be eligible to receive the dividend voted on by Shareholders during the annual General Meeting each year, plus a 10% loyalty bonus once you have owned your shares for two years.

Regular free share attributions to all Shareholders These attributions, voted on by Shareholders during the annual General Meeting, also benefit from the 10% loyalty bonus for all shares you have owned for two years.

No handling fees, no management fees Your direct registered share account will be directly managed.

Subscribe to myAL myShare 2025

Who can subscribe?

Eligible employees must have been employed by an Air Liquide Group company that is a member of the French Share Purchase Plan (FSPP) or the International Group Share Purchase Plan (IGSPP), for at least three months during the period between January 1, 2024 and November 13, 2025 (based on the indicative calendar). The three months do not need to be consecutive as long as they are in that time period.

How to pay for your subscription?

Details of the methods of payment available to you can be found in your country’s local supplement which can be obtained in the “Download documents” section.

How much may I invest?

You are free to invest as much or as little as you wish, within the following parameters:

Minimum: 1 share.

Maximum: 25% of your estimated gross annual remuneration in 2025(3).

If you pay via a payroll deduction (providing this option is authorized in your country), each monthly payment is capped at 10% of your net monthly remuneration.

(3) This criterion may vary according to local regulations. Further information can be found in your country’s local supplement which can be obtained in the “Download documents” section.

Specific rules for Russia and Belarus

As a result of sanctions imposed by the European Union, citizens or residents of Russia or Belarus may not participate in this offering, except in the following conditions:

- if he/she is a Russian national or resident of Russia, and he/she is also a citizen of a Member State of the European Union, of a country member of the European Economic Area or of Switzerland, or he/she has a temporary or permanent residence permit in one of these countries; and

- if he/she is a Belarusian national or a resident of Belarus, and he/she is also a citizen of a Member State of the European Union or he/she has a temporary or permanent residence permit in one of these Member States.

How to subscribe online in just a few clicks?

Click on the button

Log in with the specific login and password sent to you by email and/or by mail to your home address

Fill in the subscription screen

- Check your personal information and correct it where necessary

- State the number of shares you wish to purchase and your method of payment

Validate your subscription

- You will receive confirmation by email

- Your subscription cannot be canceled once the subscription period has ended

Please note before investing

Your investment tracks the Air Liquide share price performance

There is therefore a risk of loss of capital. However, the discount reduces the share purchase price compared with the market price and therefore has an amplifying effect in the event of an increase and a cushioning effect in the event of a decrease in the share price.

Note: if you are resident in a country located outside the euro zone, there is an exchange rate risk. As Air Liquide is listed in euros on the Paris stock market, the value of your investment will vary according to exchange rate fluctuations between the euro and your currency across your investment period. Thus, if the euro appreciates against your currency, the value of the shares in your currency will increase. Conversely, if the euro depreciates against your currency, the value of the shares in your currency will decrease.

Your investment is locked in for five years

However, early release clauses exist and details of these can be found in your country’s local supplement which can be obtained in the “Download documents” section.

After the five-year lock-in period, you may keep your shares in the account opened in your name at Air Liquide or sell all or some of them.

INDICATIVE CALENDAR(4)

October 29, 2025

Setting of the subscription price

From November 3 to 13, 2025

(11:59 p.m. Paris time)

Subscription period

December 9, 2025

Capital increase and creation of your shares